FEDERAL SOLAR TAX CREDIT ENDS IN 2034!

Federal Tax Credit Schedule from 2022-2034

The 30% federal solar tax credit is available for home solar systems installed by December 31, 2032. As of 2033, the residential tax credit will step down to 26%. By 2034, the tax credit will step down to 22%. By 2035, the tax credit for residential solar ends.

Installing solar is an investment for today, next year and the long term. If you’re considering buying a home solar system, act now and pay less today!

As for state incentives and rebates, there is no fixed credit. To learn more about your state’s solar rebates and incentives currently offered

NEED A

NEW ROOF?

AT-COST ROOFING FOR $0 UP-FRONT WHEN PACKAGED WITH SOLAR

Why Solar?

$150

Current MONTHLY Utility Bill

$420

Average MONTHLY Bill in 25 yrs

$1,800

Current ANNUAL Utility Bill

$5,200

Average ANNUAL Bill in 25 yrs

YOUR FUTURE PAYMENTS

WITHOUT SOLAR

$150-420 /month

NEXT 25 YEARS

OR

YOUR FUTURE PAYMENTS

WITH SOLAR

$85

avg/month

BASED ON a 25 YEAR SOLAR AGREEMENT

$ 80,500

Cost without solar

energy in the next 25 years

$ 55,500

Savings with solar energy in the next 25 years

We take care of it all, so you can simply switch your utility payments with your solar loan payments and begin your renewable journey saving you money while also saving the earth.

- INDEPENDENT ENERGY

- REBATES AND INCENTIVES

- 30% FEDERAL TAX CREDIT

- INCREASE EQUITY WITHOUT RAISING TAXES

- ZERO DOWN PAYMENT

- ROOF & TREE REMOVAL AVAILABLE

- Customizable Solar Plan

- FORECASTING OF RISING UTILITY COST

- 25 YEAR SOLAR PANEL MANUFACTURER WARRANTY

- 25 YEAR INVERTER + OPTIMIZER WARRANTY

- 25 YEAR WORKMANSHIP WARRANTY

- 50 YEAR ROOFING WARRANTY

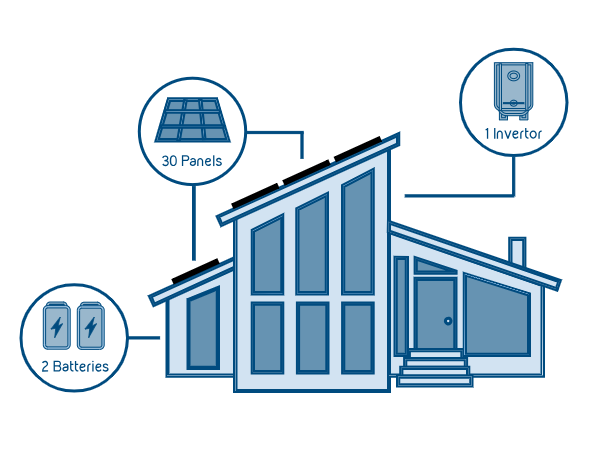

Protect your home from blackouts with the market's best battery

Go solar in 3 easy steps!!!

CONSULT

DESIGN

INSTALL

Not sure how long you will remain in your home?

LOOKING FOR

YOUR DREAM HOME?

Start saving now with your own customizable home solar system

- Calculate your savings based on your energy needs

- Design a custom system that fits you and your home

- Single-day installation